For a long time, Kamala Harris didn’t comment much on specific policies for her potential presidential administration. There’s a certain benefit to being a blank-slate candidate. People can project whatever beliefs and platforms they want onto you. I think that both Barack Obama and Donald Trump gained from being blank slates in their first presidential campaigns.

The problem is that when a candidate starts talking, they start ticking people off. As the blank canvas gets colored in, it is more difficult to see what you want to see. Of course, it isn’t impossible. People can stubbornly deny reality and remain in their bubbles.

That was the case with Kamala Harris this week. The Democratic nominee tipped her hand on a potential $5 trillion tax increase. Per the New York Times, the plan didn’t originate with Harris but was part of a package proposed by the Biden Administration last spring. Among the headline facets of the proposal were a tax on unrealized capital gains and an increase in the corporate tax rate.

Tax increases are never popular, especially in an election year, but it’s important to note here that despite claims to the contrary, the tax increases would not target anyone who earns less than $400,000. This keeps Biden’s 2020 campaign promise.

Per the Times, the plan would:

Raise the top corporate tax rate to 28 percent from 21 percent

Eliminate the ability of corporations to deduct the pay of employees who earn more than $1 million

Increases the top marginal income tax rate for individuals from 37 to 39.9 percent. The IRS website notes that this top rate is currently paid on incomes greater than $609,350 for single individuals or $731,200 for married couples filing jointly.

Increase two parallel Medicare surtaxes to five percent from 3.8 percent for Americans earning more than $400,000

Tax investment earnings as regular income instead of at a lower dividend rate for Americans earning more than $1 million

Tax some capital gains before assets are sold or before the owner dies for those with over $100 million and who don’t pay at least 25 percent on a combination of their income and their unrealized capital gains

I dislike taxes as much as the next guy, but there are two important takeaways here. First, these tax increases are targeted at the wealthy and corporations. There is a wealth of polling, including this Morning Consult poll from March, that indicates that taxing the wealthy is a popular bipartisan position. The new populists in the GOP might be surprised to learn that 69 percent of swing state voters, including 58 percent of Republicans, favored raising taxes on billionaires with similar numbers supporting higher taxes for those who earn more than $400,000. Ironically, even billionaires support tax increases on billionaires.

That may be why so many Republicans are omitting the income qualifiers on Kamala’s tax proposal. If Republican and independent voters found out that the tax hike is not on them but the wealthy, a surprising number would probably be okay with it, and my experience on the internet in recent days indicates that a lot of middle-class Americans think the tax hike would hit them.

The second important point is that the tax plan will be DOA. It will never happen.

The Biden-Harris tax plan has to go through Congress. We don’t know what the makeup of the new Congress will be, but we do know that neither party will have a filibuster-proof majority in the Senate. Even if Democrats maintain control of the Senate, they won’t have anywhere near the 60 votes required to overcome the certain filibuster.

But what if the Democrats nuke the filibuster? Well, they’ve had four years of very close votes to change that rule and they have yet to do so. In fact, the last major political figure to advocate killing the filibuster was… wait for it… Donald Trump.

Hopefully, Majority Leader Chuck Schumer - if he is still Majority Leader in the next Congress - will remember the unholy consequences unleashed when Harry Reid killed the filibuster for judicial nominees in 2013. McConnell detonated his own nuclear option by removing the filibuster for Supreme Court nominees later and the result was Democrats’ inability to block Donald Trump’s nominees as well as a more polarized and radical judiciary.

There is still the possibility of a budget reconciliation bill, the legislative vehicle used several times in recent years, including by Republicans in 2017 to pass tax cuts as part of tax reform. Budget reconciliations require only a simple majority and cannot be filibustered, but they are limited by law to addressing provisions that deal with spending, revenues, and the debt limit.

The Democrats could theoretically try to enact the tax hike as part of a budget reconciliation but the strategy has not been successful with their three-vote majority current Congress. With such a slim margin, only two votes can be lost before the bill fails.

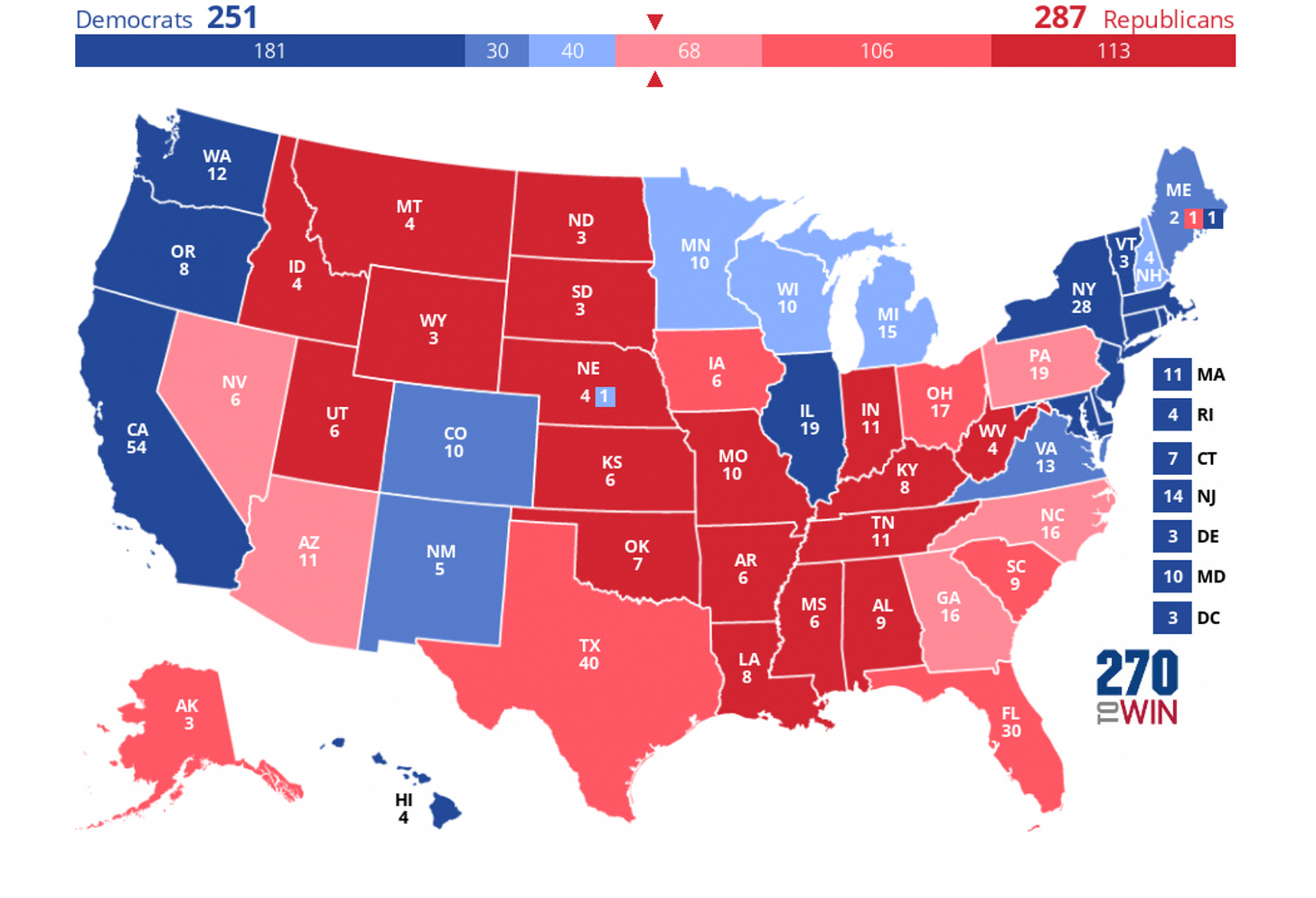

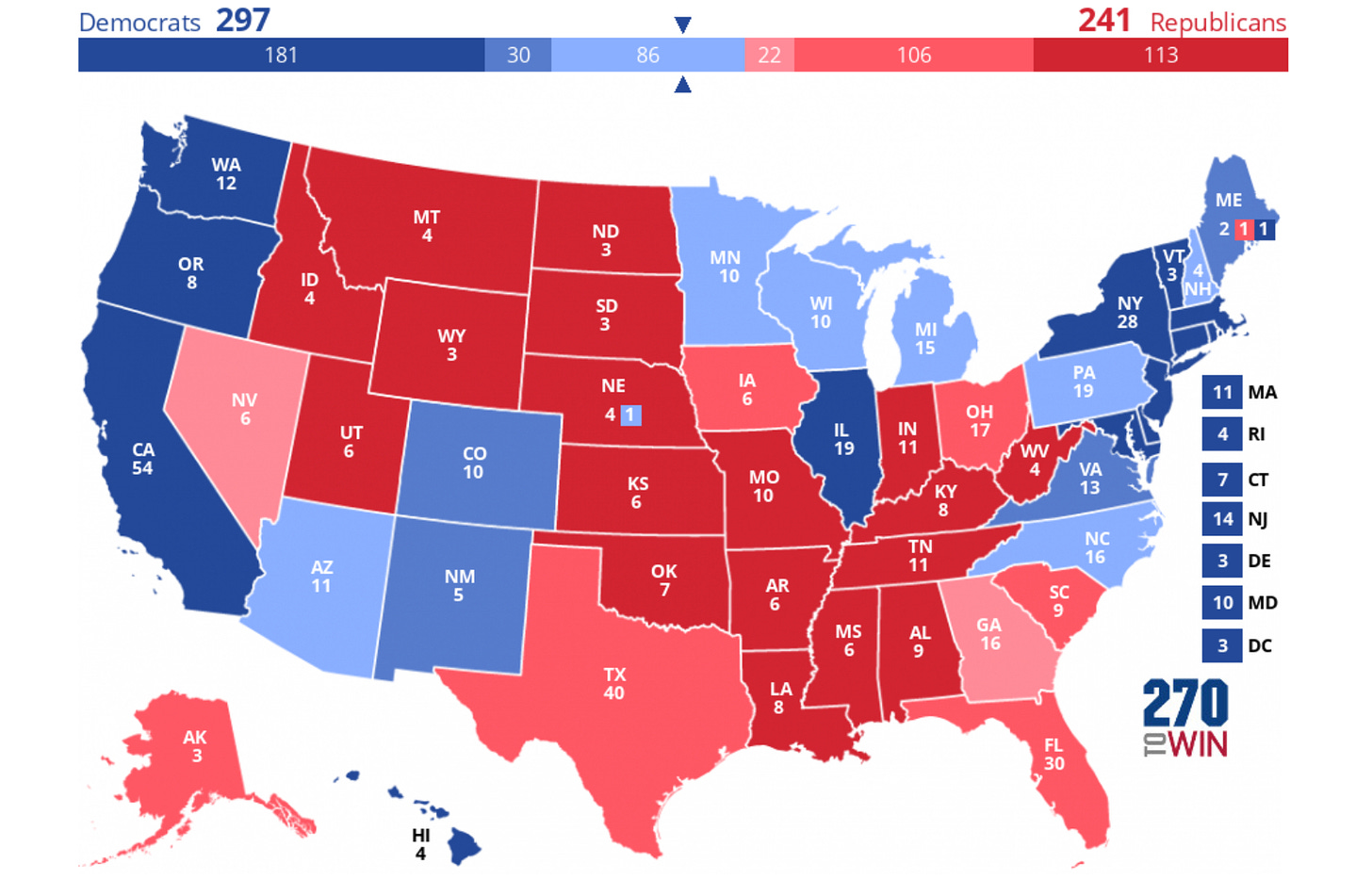

And the Democratic majority is likely to grow smaller. As Cook Political Report points out, Democrats are defending 23 Senate seats to 11 for the Republicans. One of those seats, the West Virginia seat of Joe Manchin, is almost certain to be lost. Another three Democratic seats in Michigan, Montana, and Ohio are rated as tossups while all Republican seats look safe at this point. The fact that Democrats may not have a Senate majority much longer is also a good argument against Democrats killing the filibuster.

So the tax increases almost certainly won’t happen and they won’t affect you if they do become law. But let’s take a moment to talk about the national debt.

The national debt is currently in excess of $35 trillion and growing rapidly. If we are serious about getting the debt under control, we need to consider tax increases and rule out any more tax cuts. We should also consider spending cuts, but since each side only wants to cut the other’s priorities, any spending cuts must be across the board.

I like to point out that when Republicans had the chance to cut spending under Trump, they revved it up. Some Trump spending was due to the pandemic, but even prior to the national emergency, Trump’s spending was out of control. In the final analysis, Trump will have both outspent and out-borrowed Joe Biden by trillions.

I also like to point out that the only time in decades that we have had our fiscal house in anything resembling order was under the much-maligned John Boehner. When Boehner led the House, Republicans achieved the first real spending cuts in consecutive years since 1953. Remember that fact when MAGA activists ask you what conservatism ever conserved because the MAGA Republican caucus had the opportunity to enact similar cuts in both the Trump and Biden Administrations and failed both times.

My point here is that if you believe that the national debt is a crisis, tax cuts should be off the table and tax increases should be on it. A second point is that Republicans are much more likely to rein in spending when there is a Democratic president than a Republican one. The temptation is vote largesse for their constituents is simply too tempting when they have a majority and control of Congress and the presidency.

A final point involves Donald Trump. It is extremely unlikely that Kamala Harris’s tax plan would become law, but Donald Trump has his own tax plan. Trump has advocated a national import tax of 10 percent (at times he has said 20 percent) across the board as well as a 60-percent tariff on Chinese goods. (Full disclosure, the same Morning Consult poll that I cited above also found that Trump’s tariff was popular, although not as popular as taxing the wealthy.)

The Tax Policy Center analyzed the proposal and found that Trump’s tax increase, which could be implemented by executive action under existing law, would result in decreases in income for all income groups as the economy slowed. There is a double-whammy here because Americans would be paying more in taxes as their incomes decreased. Trump’s tax would cost middle-class households about $1,350 annually.

It’s worth noting that Trump’s tariffs in his first term sparked trade wars and retaliation by our trading partners. TrumpTrade sparked a manufacturing recession and cost the US thousands of manufacturing jobs. It also killed export markets for farmers and led to billions in bailouts for Trump’s rural voters.

I’ve long joked that if you want Republicans to support a tax increase, just call it a tariff. Many Republicans don’t seem to understand that a tariff is a tax and the remainder don’t seem to understand that they, not Chinese corporations, are paying the tax.

In summary, Kamala’s tax plan is bad but it won’t happen and it won’t affect you if it does. Trump’s tariff plan is also bad and would be a near-certainty early in his Administration. Unlike the Harris tax on the wealthy, Trump’s tariff would affect Americans who buy things. That includes almost anything because even most American goods have foreign materials and components.

While I don’t like either candidate’s tax policy, one option is clearly worse for most Americans and more likely to take effect. Given a choice between two bad policies, I’ll take the one that probably won’t happen. And in this case, that matches up with the candidate who is not an insurrectionist.

Win-win.